1.

-----------------------------------------------------------------------------------

2.

-----------------------------------------------------------------------------------

3.

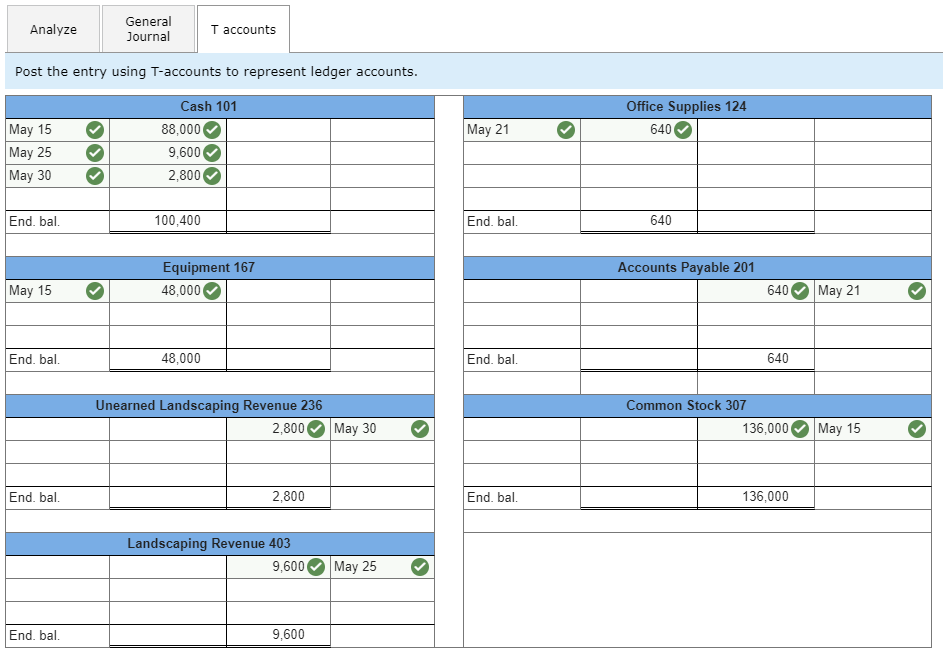

For each transaction, (1) analyze the transaction using the accounting equation, (2) record the transaction in journal entry form, and (3) post the entry using T-accounts to represent ledger accounts. Use the following (partial) chart of accounts—account numbers in parentheses: Cash (101); Accounts Receivable (106); Office Supplies (124); Trucks (153); Equipment (167); Accounts Payable (201); Unearned Landscaping Revenue (236); Common Stock (307); Dividends (319); Landscaping Revenue (403); Wages Expense (601), and Landscaping Expense (696).

-----------------------------------------------------------------------------------

4.

----------------------------------------------------------------------------------- |

No comments:

Post a Comment