Cala Manufacturing purchases a large lot on which an old building is located as part of its plans to build a new plant. The negotiated purchase price is $215,000 for the lot plus $110,000 for the old building. The company pays $34,000 to tear down the old building and $50,261 to fill and level the lot. It also pays a total of $1,465,515 in construction costs—this amount consists of $1,378,500 for the new building and $87,015 for lighting and paving a parking area next to the building.

Prepare a single journal entry to record these costs incurred by Cala, all of which are paid in cash.

| 1 | Land sum of yellowselected answer correct | 409,261selected answer correct | not attempted |

| Land improvementsselected answer correct | 87,015selected answer correct | not attempted | |

| Buildingselected answer correct | 1,378,500selected answer correct | not attempted | |

| Cashselected answer correct | not attempted | 1,874,776selected answer correct |

-----------------------------------------------------------------------------------

2.

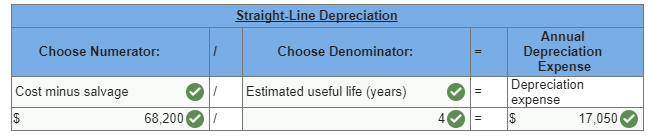

On January 2, 2017, the Matthews Band acquires sound equipment for concert performances at a cost of $69,200. The band estimates it will use this equipment for four years, during which time it anticipates performing about 200 concerts. It estimates that after four years it can sell the equipment for $1,000. During year 2017, the band performs 45 concerts.

Compute the year 2017 depreciation using the straight-line method.

-----------------------------------------------------------------------------------

|

No comments:

Post a Comment